New York offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy

Clean Energy Standard

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

New York Government

State St. and, Washington Ave, Albany, NY 12224

518-474-2418

[email protected]

Monday-Friday, 7:00 a.m.-7:00 p.m.

NY Power Authority

123 Main Street White Plains, NY 10601-3170

(914) 681-6200

[email protected]

New York State Energy Research and Development Authority

17 Columbia Circle Albany, NY 12203-6399

(518) 862-1090

Fax: 518-862-1091

[email protected]

Monday – Friday, 8:30 a.m. – 5:00 p.m.

New York Weather Bureau

175 Brookhaven Avenue Upton, NY 11973

(716) 565-0204

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

New York Clean Energy

Drive Clean Rebate for Electric Cars

Residential Solar Incentives & Financing

Energy Storage Program

Contact

Solar for All

Clean Energy and Your Comprehensive Plan

E-Mobility Technologies

and Funding

Power Outage Map

New York Office of General Services

36th Floor, Corning Tower, Empire State Plaza, Albany, NY 12242

518-474-3899

[email protected]

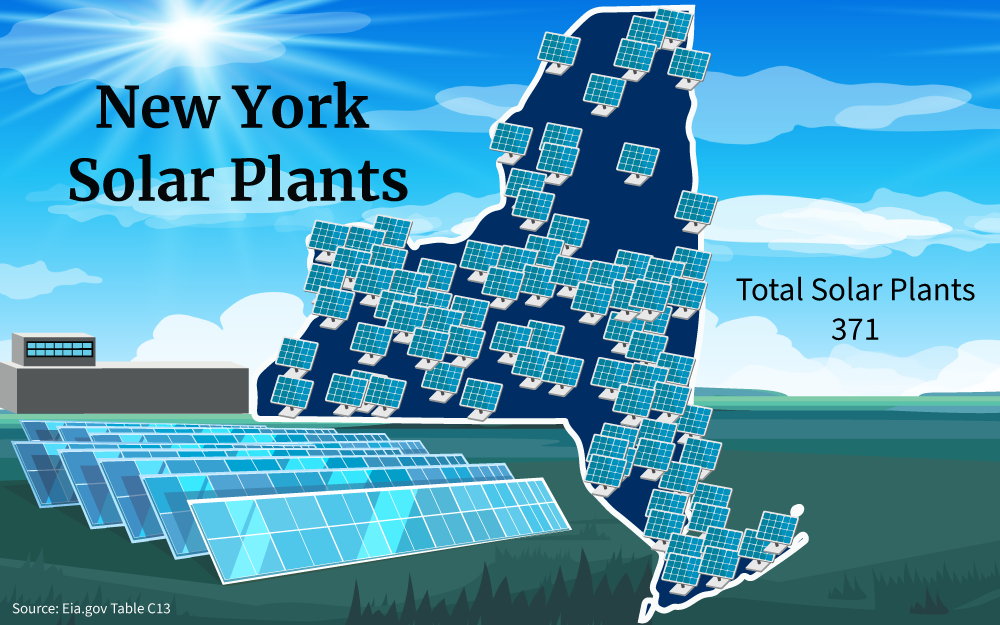

New York Solar Energy Background

With the help of New York solar incentives, nearly 500,000 homeowners in New York State have installed solar panels and are having their household electrical needs met through solar systems.

For quite some time, New York has been among the top states for solar panel installations, even though it’s not the sunniest of states, ranking 8 for solar adoption.

Climate change awareness, the falling prices of solar installations, and the money-saving New York solar incentives rolled out across the state are the reasons for the positive solar response from residents.

However, a few of these solar-friendly incentives are set to expire in the near future.

This guide explains all the solar tax credits, rebates and open enrollment options for New York residents who want to make the move and disconnect from the grid by installing a home solar energy system.

With renewable energy programs that save you money, the long term advantage of choosing solar for your electricity will reduce your utility costs and your household emissions.

New York Solar Credits Overview

It’s no secret that New York is one of the best solar markets in the country, and is committed to lowering the state’s excessive use of power from the grid.

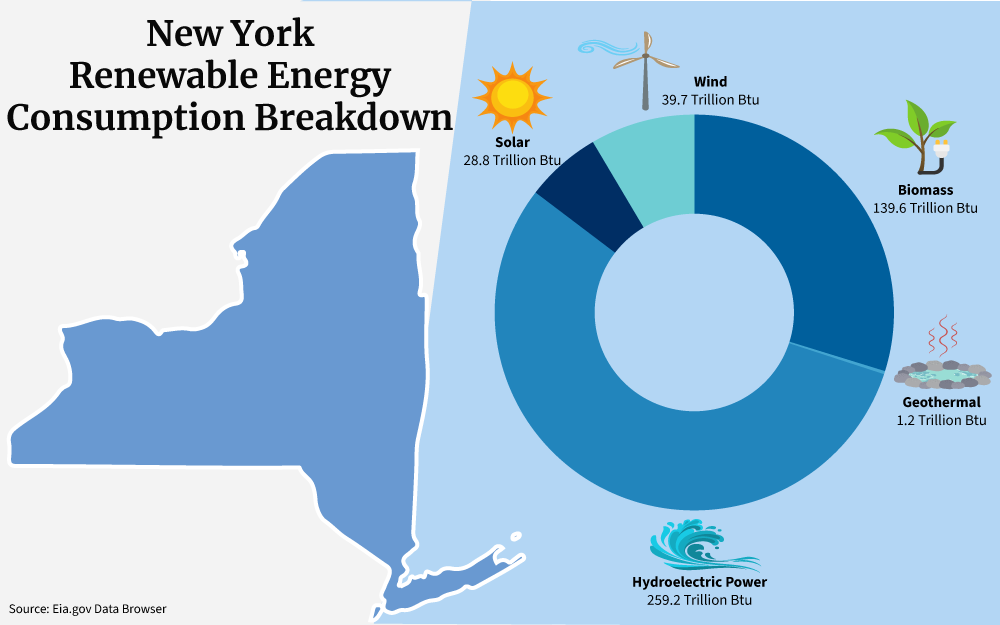

By 2030, the Clean Energy Standard program intends to have 70% of the electrical energy generated from renewable energy,1 while the Solar Energy Industries Association estimates that solar currently provides roughly 4% of the state’s power.

Here is a list of the initiatives available to residents and what they can do to lower the expense of going solar:

NY State Solar Energy System Equipment Tax Credit

A tax credit of 25% is available on the full price of a solar system including installation.

That is an impressive amount that can be discounted from your taxes, but it has a maximum cap of $5,000 that can be claimed.

NY-Sun MW Block Program

Participants benefit from a rebate structure that pays them back per watt, typically in the $.20-$0.50c range.

Federal Solar Tax Credit

Available in all states, a tax credit of 30% can be claimed by homeowners and it is very easy to apply for.

Solar Electric Generating System (SEGS) Tax Abatement

To encourage private solar installations, a 5% tax abatement initiative was started to help finance large independent rooftop residential and commercial projects up to a maximum of $62,500.

Solar Project State Sales Tax Exemption

Aimed at the commercial sector, the sales-and-use tax is exempted on installations which can save business owners over 4% on their purchase.

Net-Metering

This tried and tested method is available in the state, and credits a fair rate for any electricity sent back into the grid. New Yorkers who want to take advantage of these rebates, tax breaks, and savings should think about going solar as soon as possible before it’s too late.

Let’s look at them in a bit more detail, exactly what they offer, how they work, and if they have an expiry date.

Federal Government Solar Incentives (What Forms Do I Need To Fill Out To Get the Credit?)

The Inflation Reduction Act of 2022 is the single largest investment in American history aimed at reshaping the renewable energy landscape for the foreseeable future, and as a consumer, it is a meaningful tool for you.2 More than a worthwhile financial goal, it is an environmental instrument that has the potential to encourage millions of households to adopt clean energies and leave fossil fuels in the past.

The rebate structure of other initiatives and the ITC tax credit structures will reduce installation costs, lower utility bills, and decrease carbon emissions across the nation and the carbon footprint of every American.

Federal Solar Tax Credit

Owners of solar panels can save a significant amount of money thanks to a federal tax credit, known as the ITC. Originally started in 2006, it has undergone a resurgence thanks to the extension of its 2022 expiry date to 2035 by the Inflation Reduction Act of 2022 signed by President Joe Biden in August of that year.

After the regulation was passed into law, $369 billion was allocated for climate initiatives that produced clean energy. It also went under a name change to the Residential Clean Energy Credit but still works under the same principle.

Both residential and commercial properties, most especially for states receiving less sunlight than other sunny states, may benefit from a 30% tax credit for the cost of solar panels, batteries, and all associated equipment.

The Federal solar tax credit of 30% is discounted from the overall cost of the solar installation and reimbursed through your tax liabilities for a period of up to 5 years. There is a new expiry date of 2035 and two years before that date the ITC will drop first to 26% and then again to 22%.

The program is straightforward and is even more beneficial to those states where the cost of PV systems is anything but cheap. Solar panels in the state of New York have an average price of around $18,500 but can cost as much as $27,000 for residents with larger homes.

To apply you have to be the owner of the system and the owner of the property where the system is installed.

The application document is Form 5695 which has to be filled in with the information below, and submitted with your tax declaration:

- Address where the system is installed.

- Cost of the system: $27,000, for example

- Installers details.

- All the solar energy information about the solar panels, ratings, quantity, etc.

- Amount to be credited, 30% of $27,000 would equal $8,100.

- And your taxes for that year

If you only owe $2,000, then that amount will be deducted from the credit and you will have no taxes to pay for that year. The balance will be carried over to the next tax year when the procedure will be repeated until a 5-year period has expired.

At the end of that time, any remaining credits will not be able to be claimed and will be forfeited.

Form 5695 instructions are easy to follow, but if in any doubt your solar installer can walk you through the form so you won’t miss out on this invaluable tax break.3

Step 1: Determine Eligibility

Review the eligibility criteria to ensure that you qualify for the residential energy credits. Eligible improvements often include energy-efficient windows, doors, insulation, roofing, HVAC systems, and certain renewable energy systems like solar panels.

Step 2: Calculate the Credit

The instructions explain how to calculate the tax credits for the eligible improvements. Credits are usually based on a percentage of the cost of the qualified improvements, subject to specific limits.

Step 3: Complete Form 5695

Follow the instructions for completing Form 5695, including filling in your personal information, the types and costs of qualified energy improvements, and any other relevant details.

Step 4: Attach Documentation

The instructions will specify what documentation you need to attach to your tax return to support your claim. This may include invoices, receipts, manufacturer certifications, and other evidence of the improvements.

Step 5: Complete Your Tax Return

After completing Form 5695, you will need to include it with your annual tax return (e.g., Form 1040 or Form 1040-SR). Follow the instructions for your specific tax return to ensure you report the credits correctly.

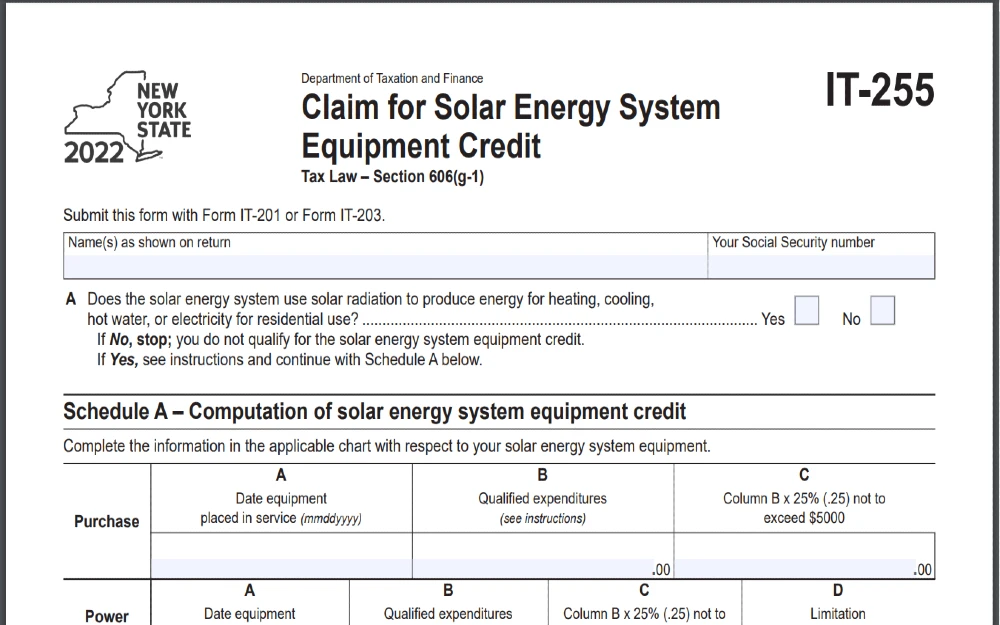

NY State Solar Energy System Equipment Tax Credit

Almost as good as the ITC, this New York initiative, however, makes available a 25% tax credit that is eligible to a wider base of applicants as really tax deductible solar panels. The only drawback is that this tax credit has a limit of $5,00, regardless of whether it is used in the installation of a residential solar system or a commercial solar installation.

In monetary terms, if the 25% of $27,000 is $6,750, only $5,000 would be claimable against your taxes over the next 5 years.

The difference with the ITC is that rather than just being open to householders who have purchased and installed a photovoltaic system outright, the program is a lot more flexible.

- It is open to anyone who has signed a long-term leasing agreement as long as they are taxpayers.

- It is open to any taxpaying resident who has entered into a Power Purchase Agreement (PPA)for at least a period of 10 years.

With a PPA, the home solar energy system is purchased and owned by a third party.

Under the terms of the contract, they agree to sell electricity generated by the solar system to the homeowner at a cent per kWh rate generally less than the local utility provider. They profit from the incentives and the differences in the rate of the electricity supplied from the grid.

It’s true that there is no limit to the amount that can be claimed under the ITC. The 30% tax credit from that program is completely based on the overall price whether it is $27,000 or $127,000.

The advantage of this program from the state of New York is that it is targeted at residents who cannot afford to purchase a PV system in cash but really want to go solar.

To apply, Form IT-255 needs to be completed and submitted along with your tax returns.4 If you have any doubts about Form IT-255 and how to fill it in, consult your tax assessor or your solar provider.5

NY-Sun MW Block Program

The NY-Sun program is very far-reaching in that it makes available financial incentives for installing solar systems on homes, businesses, and large industrial-size projects, and because of this feature, is one of the most popular New York solar incentives.

It was initially created by the New York State Energy Research and Development Authority (NYSERDA) to increase the availability of renewable energy in the state, with the amount of the incentive depending on the location and the wattage of the solar panel installation.

In order to allocate the Megawatt Block incentives fairly throughout the state, NY-Sun divides the state into two zones. It used to be 3, but Long Island has since been discontinued.

- The 12 counties covered by Con Edison

- Upstate New York

A participating NY-Sun contractor has to be contracted to install the solar panel system to enable eligibility, and the system cannot exceed 25 kW in size. Each area receives a certain amount of rewards from NY-Sun and that amount will range from $1,000 to $3,000 on average, depending on the size of your system and your location.

If you would like to know more or apply to be included in the program, go on to the NY-Sun website and liaise with them through their Contact Us page.6

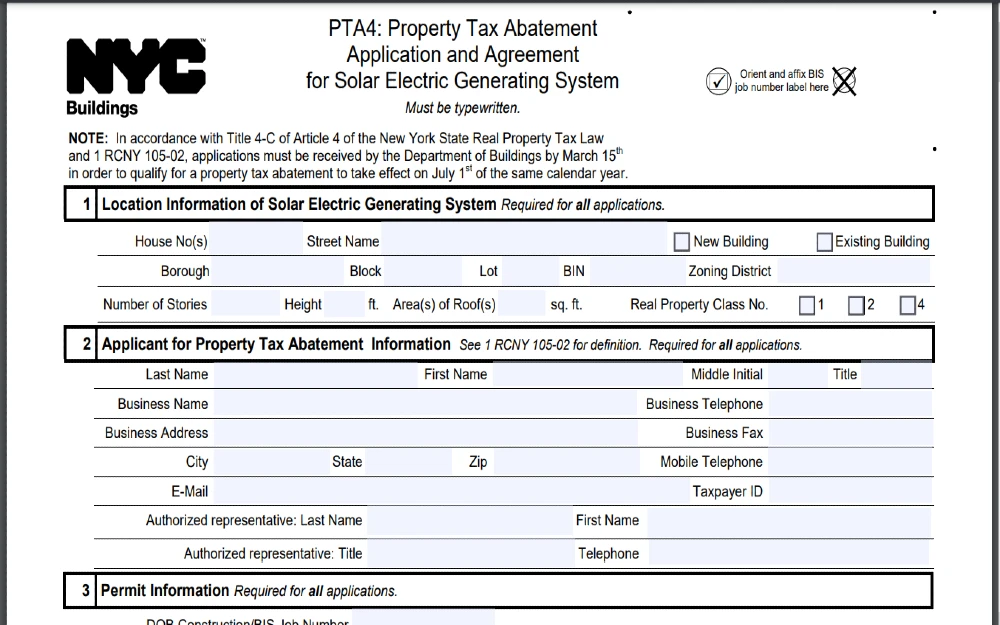

Solar Electric Generating System (SEGS) Tax Abatement

Buildings in New York City that install solar electric generating systems are eligible for a tax abatement for four years under the Solar Electric Generating Systems Tax Abatement.13

This tax exemption encourages building owners to switch to cleaner, solar energy-producing systems while simultaneously decreasing their carbon footprint by making available a 5% tax credit against qualifying expenses over the course of four years.

For that set period, the building may get a maximum abatement of up to $62,500 each year, an amount that will go a long way toward mitigating the initial expenditure of installing solar panels. If you have any questions, please get in touch with the NYC Department of Buildings (DOB).

Solar Project State Sales Tax Exemption

The ability to buy solar panels in New York and not have to pay a sales tax is saving New Yorkers a bundle.

It may not be a huge deduction, but a 4% saving on buying solar panels for home use that cost $27,000 is going to save you over $1,000.

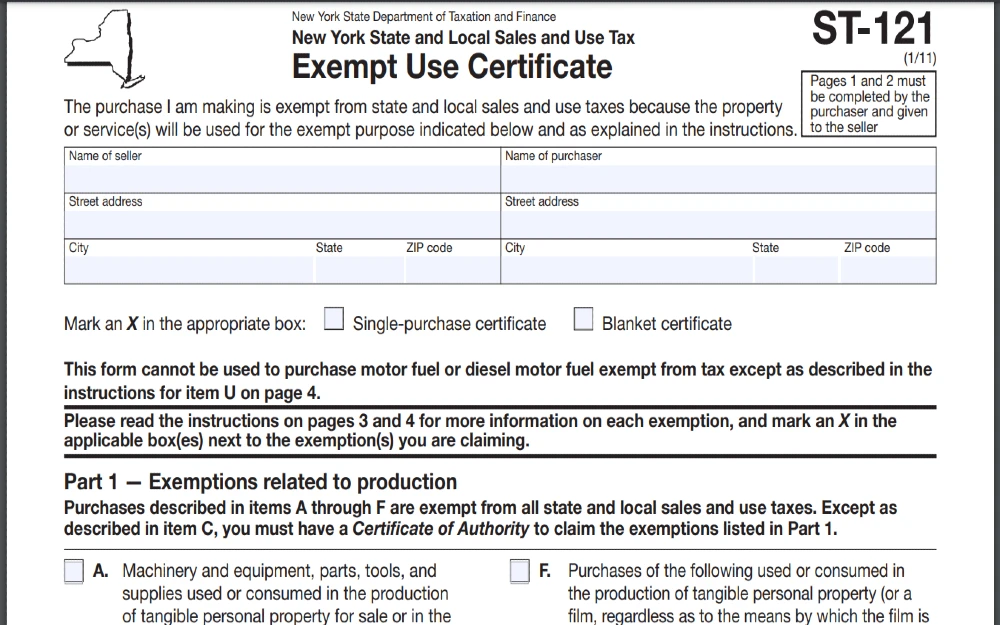

In order to make a claim you must complete Form ST-121, which is an Exempt Use Certificate that you can get from your tax office, and fill in Part III, Box T, in order to get this sales exemption.7

Net-Metering: Can I Sell Power Back to the Grid?

The idea behind “net metering” is simple: if you put solar panels on your roof, you get to utilize the electricity they generate first, with any excess “stored” in the utility grid as credits.

If your house consumes 100 kWh per month from the utility, for example, and your solar system exports 25 kWh to the grid, your final bill will be based only on the 75 kWh consumed.

Credits accrued will carry over from one billing cycle to the next. Any unused portion of a credit not utilized at the end of the year will be carried over to the next year’s service.

Any unused net metering credits, however, will expire and be forfeited at the end of the 20-year period which is the new legislation in place.

The state’s Public Service Commission (PSC) came up with a new solar billing scheme called VDER (Value of Distributed Energy Resources, or Value Stack), to address some of the financial challenges brought on by net metering, and it is unlikely to continue to exist in its present format for much longer.

Their reasoning behind the change was that even though net metering provided significant financial benefits to solar power users, it also placed additional strain on power companies, and the system and distributed extra cost onto the bills of non-solar customers.

To relieve these consumers of shouldering all the additional expenses accrued by customers using net metering,8 any new subscribers who install solar panels in New York would now be subject to a monthly fee known as the Customer Benefit Contribution (CBC) charge.

The amount is determined by the size of your solar array and the rates charged by your local utility so will vary considerably. Confirm what the rates are from your provider if you are considering the net metering route, which is still very attractive despite the upcoming changes.

An additional advantage of net metering to many homeowners is that it can be combined with Power Purchase Agreements, which will virtually enable you to get a free solar installation, or almost at the very least.

Under this scenario, your solar company or another entity enters into a PPA contract with you for up to 20 years.

The company pays for all aspects of the installation and upkeep of the apparatus, and in exchange, you purchase renewable power generated from the solar array through their net metering contract. They receive the benefits of any applicable tax credits or rebates, along with the difference in the kWh rates they have negotiated with the utility provider.

In the long run, net metering is the most cost-effective option when it comes to power savings and will lower your energy bill. By how much depends on your energy use, the size of your solar array, and your utility company’s power tariff.

In New York, installing a photovoltaic system has the potential to completely replace your utility company.

Solar Panel Calculator: Requirements and Cost Savings

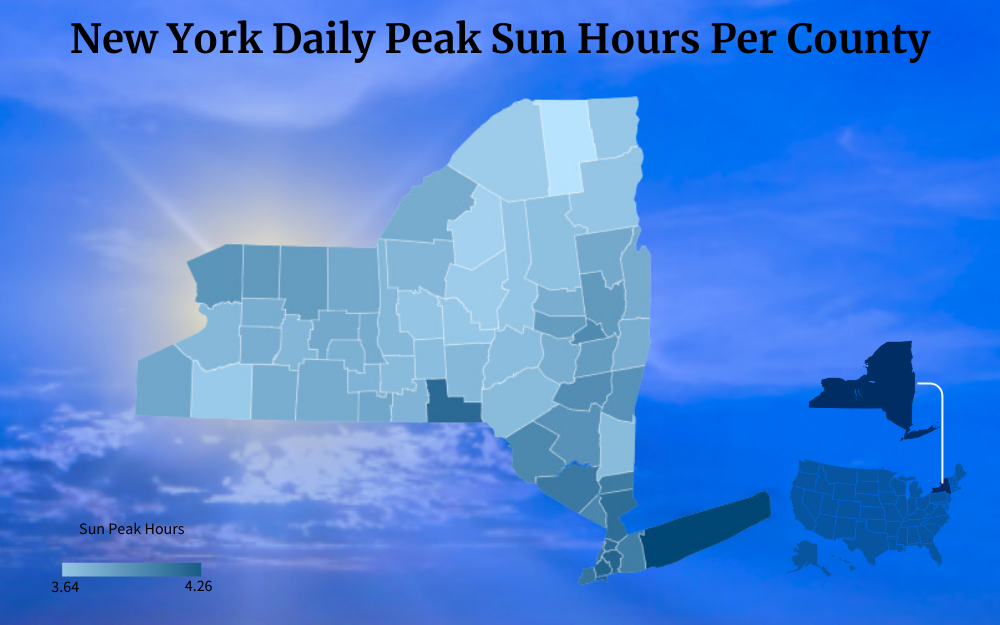

Solar panels for residential properties are generally rated at about 400 kWh, and between 17-21 are the average number installed on rooftops. This can be higher as factory ratings are not representative of actual solar cell output under working conditions where daily peak sun exposure is very rarely consistent.9

Another concern is, do you have enough roof space to accommodate them all?

If you use the amount of peak sun hours, how many kWh of electricity you use on a monthly basis, and the solar panel ratings, you can get an idea of how many you will need. But allow an additional 25% so you won’t encounter any problems with solar energy production.

If we use 900 kWh per month as the New York household average, although yours could be less or higher so check your utility bill, and 4 hours of peak sun, the formula would look like this:

- First, multiply 4 X 30 days to get monthly peak sun hours total (120)

- 900 kWh / 120 = 7.5 kWh system

- 7.5 X 1,000 = 7,500W

- 7500 / 400 = 18.75 solar panels

- 19 x 25% = 23-24 solar panels

An online calculator is a more accurate tool to calculate how many panels you are going to need, and how much they are going to cost you as more information will have to be filled in.

And it can give you more flexibility to make savings by installing larger solar panels, and it will ensure that you don’t order surplus solar panels by mistake. More power is good, but why pay for more energy when you are unlikely to need it?

How To Choose Solar Panels in NY

There are some 750 solar companies in the state of New York. Rather than contact every single one of them to get a price, eliminate those that have not been in business for very long, those that have a bad reputation online, or even those that are exorbitantly expensive.

- You need a company that has been in business for years so they will be around to honor their warranty, which also needs to be examined for content.

- You want to be able to see some of their previously installed projects.

- Ask if they comply with all the solar panel regulations and that they are fully insured.

- The North American Board of Certified Energy Practitioners is an important certification. Make sure that the company’s installers have it.

Take your time and ensure that the solar panel vendor you employ is in conformity with all relevant laws and local rules, can offer you a first-rate product, and will still be in business for any after-sales support needed in the future.

Solar Energy Facts in New York

Except for Hawaii and Rhode Island, New Yorkers utilize less total energy per capita than inhabitants of other states even though it is the fourth most populous state in the United States.

During New York’s winters, overall energy usage skyrockets as temperatures plummet, and demand for heating demand rises.

Solar power still works during the windswept chilly days even if they are not as bright as during long summer months.10 They can still generate enough energy to cushion the extra costs of heating the home and by doing so ensure that the electricity bill is not a hot topic of conversation in the dead of a cold night.

That may not have been common knowledge in the Big Apple, but solar panels are still effective when the sun is not blazing across the sky. Here are a few more solar energy facts in New York that you may not be aware of:

- There are 190,000 solar installations in the state, bringing electricity to nearly 760,000 homes.

- Approximately 4.41% of the electrical power in the state comes from solar generation.

- The industry has created 11,512 jobs.

- Close to $10 billion has been invested in the solar sector to date.

- Going solar in New York has been evaluated as having the same climate mitigation as planting 20 trees a year.

- Entrepreneurs and some companies have started utility-size solar farms in the state to support energy production and distribution to thousands of homes.

- Installing a rooftop solar system can save the average homeowner in the region of $90 a month.

Every state in the country has set a target of how many megawatts of renewable energy they want to be generating from solar PVs – and New York is no different.

By 2025, the state has a goal of generating between 6,000 to 10,000 megawatts of energy solely from solar.

At the moment they are in 8th position for installations across the country and are taking a positive step by providing residents with New York solar incentives that reduce the cost of solar panel installation in the state.

Frequently Asked Questions About New York Solar Incentives

How Much Does It Cost for Solar Power Systems?

With the tax-deductible solar panels options in New York, the cost of the entire system, the solar power cells, inverters, junction box, charge controllers, racking, and monitors, the cost of the PV can be reduced significantly from the average quoted price of between $18,500 – $27,000.

What Is a Solar Panel Made Of?

If you’re wondering, what is a solar panel made of, solar panels are made from glass encased in an aluminum frame, plastics, silicon wafers made from sand, copper, and silver, and a lot of wiring.

Are Solar Panels Good for the Environment?

Solar panels’ sustainability revolves around it as a clean renewable energy source that has a small environmental impact during the manufacturing and recycling stages but throughout its lifespan. So if you’re wondering, are solar panels good for the environment, yes, it is one of the most potent tools for combating the effects of climate change.11

References

1Ciolkosz, D. (2023, March 9). What is Renewable Energy? Penn State Extension. Retrieved August 31, 2023, from <https://extension.psu.edu/what-is-renewable-energy>

2Minos, S. (2022, August 22). Inflation Reduction Act of 2022 – What it Means for You. Office of Energy Saver. Retrieved August 31, 2023, from <https://www.energy.gov/energysaver/articles/inflation-reduction-act-2022-what-it-means-you>

3Funkhouser, D. (2018, March 16). How Much Do Renewables Actually Depend on Tax Breaks? Columbia Climate School | State of the Planet. Retrieved August 31, 2023, from <https://news.climate.columbia.edu/2018/03/16/how-much-do-renewables-actually-depend-on-tax-breaks/>

4New York State. (2022, October 13). Instructions for Form IT-255 | Claim for Solar Energy System Equipment Credit [PDF File]. Department of Taxation and Finance | New York State. Retrieved August 31, 2023, from <https://www.tax.ny.gov/pdf/current_forms/it/it255i.pdf>

5New York State. (2022, October 13). Claim for Solar Energy System Equipment Credit. New York State | Department of Taxation and Finance. Retrieved August 31, 2023, from <https://www.tax.ny.gov/pdf/current_forms/it/it255_fill_in.pdf>

6New York State. (2014, November 7). Contact NY Sun. New York State | NYSERDA. Retrieved August 31, 2023, from <https://www.nyserda.ny.gov/All-Programs/NY-Sun/Contact-Us>

7New York State. (2005, September 6). Sales and Use Tax Exemption For Residential Solar Energy Systems Equipment. New York State | Department of Taxation and Finance. Retrieved August 31, 2023, from <https://www.tax.ny.gov/pdf/memos/sales/m05_11s.pdf>

8Musgrave, G. (2023, March 9). The Origins and Meaning of Net Metering. Penn State Extension. Retrieved August 31, 2023, from <https://extension.psu.edu/the-origins-and-meaning-of-net-metering>

9Schiavone, D. (2023, June 28). Working on Solar Panels and Power Output (FS-2022-0646). University of Maryland Extension. Retrieved August 31, 2023, from <https://extension.umd.edu/extension.umd.edu/resource/working-solar-panels-and-power-output-fs-2022-0646>

10Kerr, E., & Burrus, A. (2019, March 21). The Future of Solar is Bright. Harvard University. Retrieved August 31, 2023, from <https://sitn.hms.harvard.edu/flash/2019/future-solar-bright/>

11Massachusetts Institute of Technology. (2023). What We Know About Climate Change. MIT Climate Portal. Retrieved August 31, 2023, from <https://climate.mit.edu/what-we-know-about-climate-change>

12Screenshot of Form ST-121 (Exempt Use Certificate). New York State. Retrieved from <https://www.tax.ny.gov/pdf/current_forms/st/st121_fill_in.pdf>

13Screenshot of Form PTA4. City of New York. Retrieved from <https://www.nyc.gov/assets/buildings/pdf/pta4.pdf>